Eurizon’s approach to sustainability

Here at Eurizon, we believe the integration of environmental, social and governance (ESG) factors, and of the sustainable and responsible investment (SRI) principles, is functional to achieving sustainable performances over time, and we strive to promote behaviours oriented towards long-term choices.

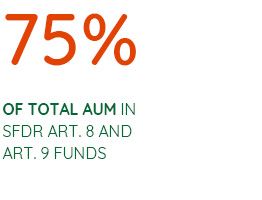

Data as at December 2024

Eurizon’s commitment to ESG and SRI themes

For Eurizon, sustainability is Future, Innovation, Research

Document drafted for marketing ends. Before making any investment decision and making an informed choice on the opportunity of investing, please read carefully the Key Information Document (KID), the Prospectus, the Fund Management Rules, and the subscription form. These documents describe the rights of investors, the nature of this Fund, the costs and risks it implies, and are available free of charge from the Internet website www.eurizoncapital.com as well as from distributors. The documents are available in paper format as well from the Asset Management Company or the Depositary Bank, on written request. KIDs are available in the official language of the country in which the country of distribution. The Prospectus is available in Italian and English. The Asset management Company may decide to end the provisions adopted for the marketing of its undertakings for collective investment, as per Art. 93 of Directive 2009/65/EC, and Art. 32 of Directive 2011/61/EU.

This document is not addressed to persons in jurisdictions where the offer to the public of financial products, or the promotion and placing of investment services and activity is not authorised, or to whom it is illegal to address such offers or promotions. For further information, please read the legal notices.