Heading for Net Zero

6 minutes

6 minutes The role of the financial community in support of the planet

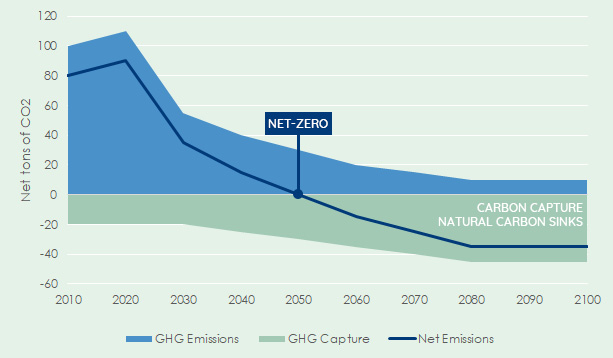

The Paris Agreement, and the subsequent accords reached on protecting our planet, have highlighted the need to immediately start reducing greenhouse gas emissions, to achieve carbon neutrality (Net Zero) by 2050. Therefore, greenhouse gas emissions into the atmosphere will have to progressively be reduced by making production processes more efficient by using new techniques, and reabsorbed principally by adopting innovative capturing and storing technologies, and residually by enhancing natural resources such as forests, the soil, and the oceans (carbon sink*).

To achieve this ambitious goal, the change must involve the civil society and all business sectors, including the financial sector, that has a leading role to play.

The financial community has the possibility of accelerating the processes, channelling capitals towards more sustainable models and new technologies, investing in companies already involved in the transition to zero net emissions, and supporting those that are less sustainable at the present stage, but tangibly show they are ready to make the transition.

Here at Eurizon, we intend to be at the forefront of this change.

The Net Zero Asset Managers Initiative (NZAMI)

Over the years, the agreements reached by governments and EU regulations on the reduction of greenhouse gas emissions have been joined by a number of non-governmental projects aimed at tangibly contributing to the achievement of sustainability goals.

In the financial field, a number of alliances have been established at the global level, that bring together different sector institutions. One of them is the Net Zero Asset Managers Initiative (NZAMI), launched in December 2020.

In a nutshell, the initiative is aimed at:

Eurizon and Net Zero

In November 2021, Eurizon was the first Italian asset management company to join the Net Zero Asset Managers Initiative, making the commitment, among others, to collaborate with the companies in which it invests to help them achieve tangible decarbonisation goals.

The first steps in achieving the Net Zero goal are to identify the assets to include in the so-called “In-Scope Portfolio”, that will be managed with the aim of achieving carbon neutrality by 2050, and the la definition of four targets: Asset Level Alignment Target, Portfolio Level Reference Target, Stewardship Target, and the Climate Solution Target.

Asset Level Alignment Target

Portfolio Level Reference Target

Stewardship Target

Investment in Climate Solutions Target

United for our future

*A Carbon Sink is any system or activity (natural or artificial) that is capable of absorbing and storing more CO2 than it releases (if any). For instance, the oceans, forests, or any industrial technology that reduces the carbon footprint, are all carbon sinks. Source: Eurizon Capital SGR.

***Eurizon’s “In-Scope Portfolios”, and definitions of Scope 1, 2, and 3

Emissions are classified as:

Scope 1: direct greenhouse gas emissions that occur from sources that are controlled or owned by the company, both fixed (boilers, power generators, industrial processes) and mobile (for instance vehicles).

Scope 2: indirect greenhouse gas emissions associated with the energy purchased and consumed by the company.

Scope 3: indirect emissions associated with the value chain, other than those classified as Scope 2.

Eurizon has chosen to use the Net Zero Investment Framework as its benchmark methodology, and has also established as the asset classes considered in this initial phase Listed Equity and Corporate Fixed Income, excluding for the time being government bonds, due to the limited number of methodologies, still in a consolidation phase.

Eurizon has included in the “In-Scope Portfolio” its mutual investment funds under Italian and Luxembourg law with active management, and with a direct exposure of at least 95% to the asset classes in question.

November 2022

Document drafted for marketing ends. The information, forecasts, and opinions contained in this document are drawn up exclusively in relation to the date of writing, and no guarantee is offered that the results, or any other future event, will be consistent with the opinions, forecasts, or estimates offered herein. The information and forecasts provided, and the opinions contained in this document, are based on sources considered reliable and in good faith. However, no declaration or guarantee, explicit or implicit, is offered by Eurizon Capital SGR S.p.A. on their accuracy, exhaustiveness, and correctness. Any information contained in this document may be changed or updated, after the date of publishing. Eurizon Capital SGR S.p.A. and its administrators or employees, cannot be held liable for any damages deriving form the fact that someone may have relied on the information contained in this document, and are not responsible for any errors and/or omissions contained in the aforementioned information. The information contained in this document cannot be copied, reproduced, or redistributed, entirely or in part, without the prior written consent of Eurizon Capital SGR S.p.A.

The value of the investment, and the return generated by the investment, are subject to fluctuations, may increase or diminish. Therefore, fund subscribers may lose all or part of the capital initially invested. Before making a final investment decision, please read the Prospectus and the Key Information Document (KID).